Commodity or Variety?

In a previous life, I owned 3 bookstores. The stores were made up sales wise by 1/3 games, 1/3 comics and 1/3 new and used books. But in linear space it was quite different. Books make up 90% of the space. As a matter of fact I had over 70,000 books in just the main store alone. Games and comics made up the other 10%. So one could ask, why all the space or books that made up the same amount of sales as the others? Because I had learned from a wise man years before that some departments or categories need more variety or space than others do. In other words, if you don't have enough space dedicated to books, you aren't a book store.

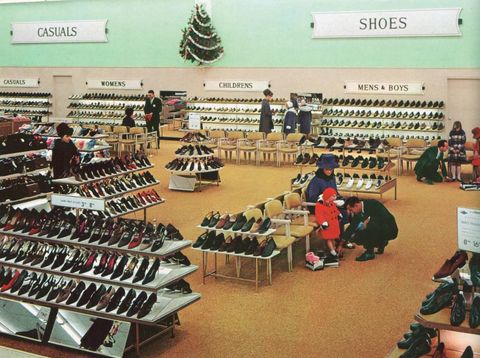

Its the same with many of the departments or categories in retail. I will relate the story that I heard from a senior member of a very large and very old retail company in Canada about shoes.

In the 1960s and 70s a very large department store chain was the key place to go for shoes. They sold more than 60% of all the shoes sold in their national market at the time.

An analyst realized that almost 85% of the sales were done in only 2 brands that made up less than 10% of the space that was currently allotted to shoes at the time. When this was brought to the attention of the personnel in charge, they determined to cut over 75% of the space out of shoes. Keep the brands that sold and increase the space they were being given. Then they would take the extra space and designate it to different departments. Within 3 years, the department store chain had lost its market share and struggled to be relevent ever again in the shoe category.

What happened? They were no longer in the shoe business. When consumers started demanding assortment, it opened the door for a flood of new shoe store chains to come in. And they brought assortment, price and service.

The learning is that we need to understand most of the time what kind of a category or department you have. Is it just about a commodity such as bathroom tissue, or is it about meeting the demand of assortment such as baking? As we work through our categories and department assortments, we need to determine the damage that can sometimes come from too little assortment in assortment or variety driven categories vs the commodity categories. Some people want chocolate cake and some people want swiss chocolate cake and some people want devil's food cake. We need to understand what the needs and the buy cycles are of the consumer and ensure that we are meeting their needs as much as they are meeting the needs of the company. Because if we are too far removed from the consumer, we begin to make mistakes that could cost us market share just like the shoes.

The Closer you Get to a Perfect Planogram, the Farther You are Away from It

What does it mean to

have a perfect planogram? Is the spacing correct by brand or item? Can AI continue to build better planograms that become the only thing that we see? I have been working with the rules of space management software since 1994. Since then, we have continued to try and build automated planogramming. But they never really worked. Why?

We were working the hard way with excel spreadsheets back in the 1990's and before we had a program to help at the stores, we would make changes and then measure them day after day against a trend rate. We discovered that just changing the section would often give a boost to sales. We also discovered that by going against what we may know for space to sales ratios, and over spaced certain items, we could bring more attention and therefore sales to the items.

We also discovered that not all categories or sub categories or for that matter, items worked the same way. It was the same with displays. I spent the next 25 years working on breaking down items and categories so that we can better understand what to do with them. And even so....sometimes its just different things grab our attention. Not so different that we call it ugly, but different enough that it is trendy, or fashionable.

Discover what's special about the items, the categories and don't treat them the same. Some are commodities, some are about taste, and some are just about differentiation. How many flavors of tea do you have?

The Value of Shelf Space Real Estate

I’ve been in this business of Retail for over 40 years and I’ve learned a few things. I have worked through all the different positions with different companies at store level, corporate level, managed billions of dollars per year and worked with Nielsen where I learned how to read and manipulate numbers properly and improperly. I learned how numbers make the world go ‘round.

Let’s start with a fact. Offices don’t sell products. Stores sell products. Websites sell products. And retail is also in the entertainment game. The more enjoyable the store experience, as long as we still meet the need of price, product and promotion, the more we will sell to the customers. It is as we go about our Saturday grocery shopping or head down to the hardware store, that the retailers have opportunity to compete and see if how they may yet entice the consumers to shop in their stores.

But let’s be clear, the stores are also landlords to the products and positions of the products in their store. So, if a product can’t pay the rent by creating sales, profit or differentiation, then that product has no business in the store.

The world of Retail that many of us live in, is very exciting and covers many different facets of our lives. It is here in Retail that we see the success or failure of many of our hopes and dreams. Whether you are a real estate developer, a writer, a baker with a new recipe or an old fashioned bookstore, it is through the world of Retail, online or bricks and mortar, that the majority of sales will be still be accomplished.

This is really where our story begins. We are looking to not be the advertisers of items, not the buyers of product or the personnel managers inside the stores. No, it is here that we want to begin to understand the presentation of products on the shelf and in the stores.

How we present the items on the shelf, how much space is allocated to the item is important to the decision process of the consumer as well as the profitability of the category,

....store or business unit that exists within the retail environment.

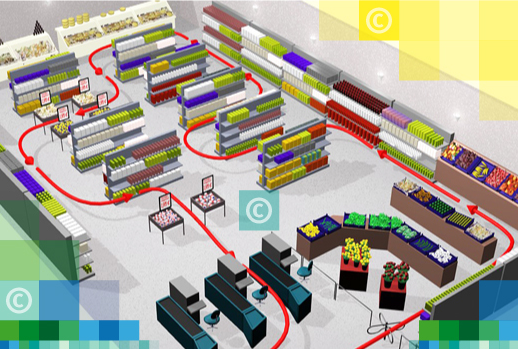

As Retail has changed over the past ten or twenty years, we have started to see other factors that are going to play a large part of the reason that we need to pay more attention to what it is we are going to do with the merchandising opportunities within a store. In the end everything is about the store. A single store, a group of stores, a chain of stores, it is always about the store. What we do there and how we deal with the consumer. Data tells us that we can affect the decisions of the consumer as they stand in front of our sections within a store 70% of the time.

This means that it is tremendously important to understand how we can affect the changes in the decision making process of the consumer. It is also important that we understand what the relationships are between products that are adjacent to each other on shelf and how these relationships are impacted through promotion and placement of different products that the consumer may be looking to purchase.

For example if we are in the laundry detergent aisle, we want to be able to assist the consumer in making their decision easier. We also want to assist them in purchasing the product that we want them to purchase.

Maybe it is for higher margin. Maybe it is for price recognition. Whatever it is, we also hope that this purchase will also trigger the purchase of another item for the consumer to pick up that will increase our profitability and increase the opportunities for the consumer to have a better shopping experience by finding the products and solutions they are looking for.

We can impact the consumer’s decision on what they are going to purchase 70% of the time if we have merchandised it correctly.

Back in the Day

I started in the grocery industry in 1978. At that time I went to work in a small store. The butcher really was a butcher by trade and had been for over 30 years. The senior clerks had 15 – 20 years of experience. I was a novice and as such only allowed to even work with specific departments and items. I began to learn the grocer’s trade. Back then it was a job that paid well and had good benefits. It was an honorable profession and would have many years ahead of learning and there was a great deal of pride in a job well done.

But as we have seen with the increase in competition from other Grocery Retailers as well as outside channels, there began to be a decrease in the benefits. It was thought that as a labor job, we did not need to be paying as well as other industries did for labor. This also meant that we hired more students and part time people into the industry.

When I began, we needed to be able to price, cut and place 60 pieces per hour at a minimum in order to keep your job after a period of training. Today with the part time clerks and in between profession people, we see significantly less pieces per hour. We have down graded our productivity. Not only that, but a person took a great deal of pride in how they cut in new items back then. We used the basic merchandising principles that were taught to us in making the decisions about where to place a product.

Understanding how and why a consumer would make a decision to pick up an item had a great deal to do with why we placed the items where we did.

Today we cannot say the same thing. We have part time people who do not necessarily understand the basic concepts of merchandising working in our stores. Placing the new products on the shelf and not necessarily understanding the relationship of this item to the items around it. Have you ever walked into a store and wondered why the mustard was in two different places within the same

condiment section?

How is it that we will be able to communicate the opportunities for proper shelf placement? How do we leverage the knowhow from the few to the many people within our organizations? We need to understand how to merchandize, how to communicate this and how to measure it. We need to understand how important it is to place those items properly. 70% of the time, we can change a consumer’s mind. That is a lot!

“If they're not getting it from you, they're

probably getting it from your competitor”

Advertising gets people in our doors. Specific items or categories pull people to certain sections of the store. But then what? How do we get someone to choose a House Brand over a National Brand? Is it just price? Is it just packaging? Or is it also about where it is placed?

We need to think about the Value of our Real Estate and how to get the most out of it.

Let's Really Talk Localization

Everyone is talking about local products, local involvement, local, local, local.... But sometimes we talk about it, but we don't really understand it.

Locally manufactured product is sometimes perfect for showing off local, but sometimes its actually about what people are looking to buy that may be different.

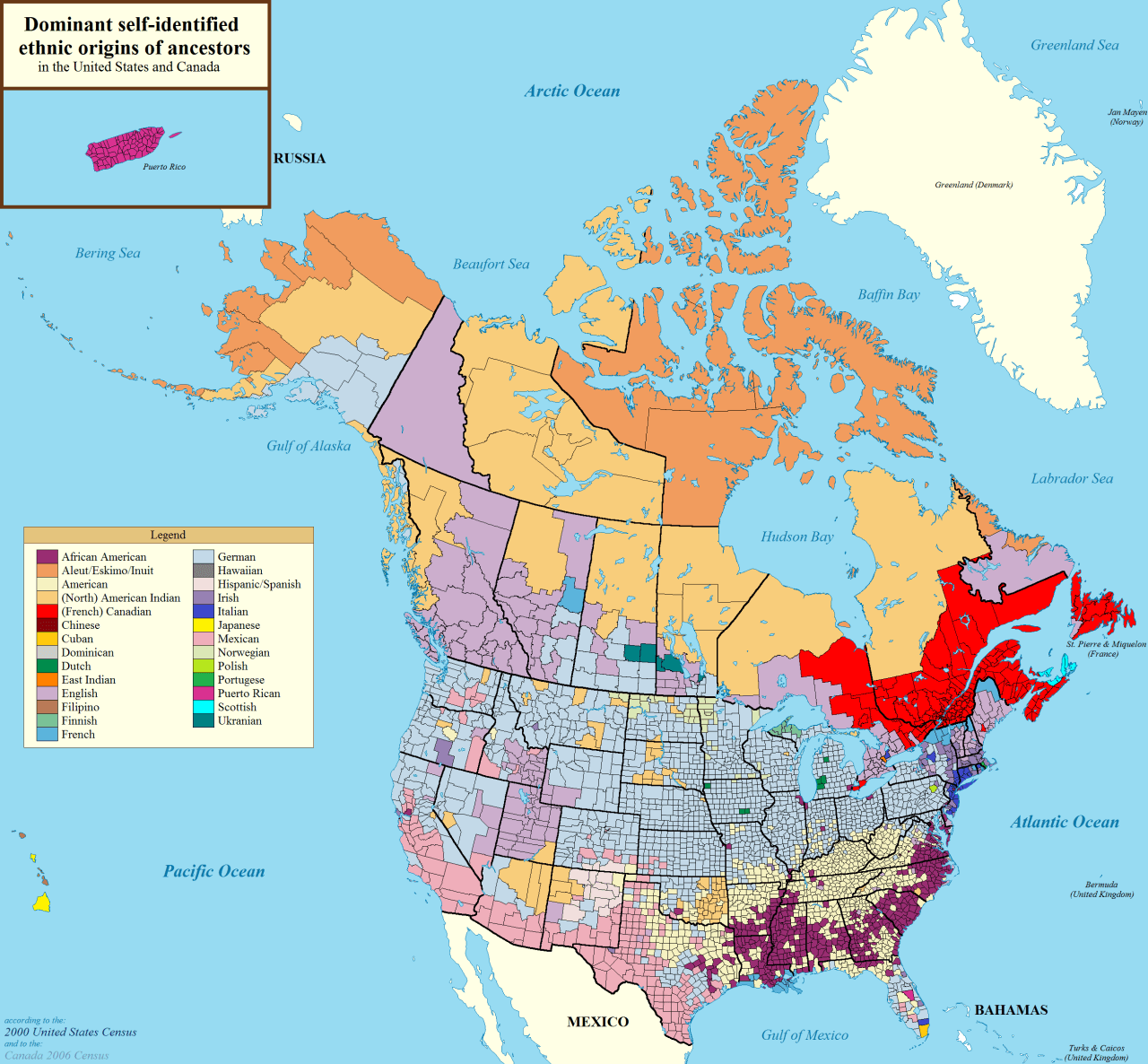

Over the past many generations, people have moved to different parts of the continent or country and many have gone back to where they came from, many have stayed and many just moved on because it wasn't quite right for them.

This is a reality that hits us every time we go to a store. I heard a person say once that more than 80 percent of products are the same across the country. Really only 10 - 20% are truly different. That may be true, but how much they eat of the 80% can vary greatly.

For example, did you know that in both Canada and the United States, people from the west eat dramatically more salsa than they do in the east. And I mean dramatically. So it could be said that all areas eat salsa, but it wouldn't be true about the same skus and assortments related to salsa and for that purpose, even mexican food.

It is the same for many different foods across the country. It has to do with taste that can be affected by ethnicity, geography etc. The eastern US and Canada eat a parboiled rice because of the influence from the islands off the coast and Africa. This continues on. Apple Juice, sour dough bread, Italian tomatoes, ribs and even the kind of cuts of meat and fish that we eat.

Interesting Fact:BBQ Flavor Lays Chips are Slightly Different Between East and West. One is Sweeter than the Other.

So what kind of impact does that have on local? Well, taste preference impacts products, skus, sizes, pricing etc. How close to the coast or what elevation that you are at and how far north you are may make a difference. What is the population and is it tundra, mountains or swamp.

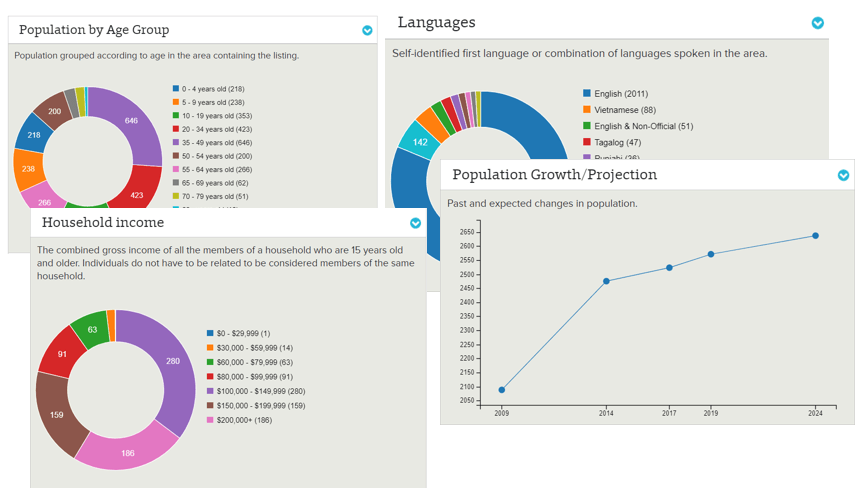

If we take population breakdown with economic breakdown, language and culture, we can then take products that are similar to each market's socioeconomic break to make better decisions about product that will appeal to the customer's taste and affordability.

We do this running the data against algorithms to define items that meet our different conditions such as cost, better for you, ethnicity etc. Once we have those pieces of information, we can identify key items that are missing by small local vendors, but also by big vendors that may just need adjustments in size or taste to be more relevant.

How do we make adjustments and track that by store? Well, that's for another day...

Grocery Innovations Canada

October 22 and 23rd, we had the opportunity to introduce our team to the CFIG members through the main Toronto show. We had the opportunity to meet hundreds of Manufacturers, Retailers and Service providers in an atmosphere that allowed us to all feel the passion and excitement of the business that we are all in.

Having said that, it was very exciting to see that we truly had something to add to what was going on. Between our team we have 150years+ of experience on all sides of the business. Our group of consultants represent data providing and analytics, operations at store level, category and merchandising management and technology backgrounds that are astounding from simple database development to reporting, retail camera and robotic tech etc. We focused on 4 main groupings and the interest by both Retailers and Vendors was great.

1. Affordable Space Management Software. This software is normally incredibly expensive, but we are working directly with the developer who used to work on this for other companies, to bring a low cost entry with all the power of the higher cost competitors including automation pieces and fully integrated database tech to work with any of the major systems in North America today.2. Inexpensive Customer and Employee camera technology. This allows us to identify people who need assistance and contact them utilizing cell phone technology. No more listening for announcements but instead, direct contact to the department or store managers on duty.3. Store Scanning Technology that is innovative, fast and allows us to directly connect a store's assortment and different fixtures to Space and Category Management as well as Store Planning to ensure that we have the proper products and fixtures associated with the stores. We can then begin to drive better compliance but also better communication with the stores.4. Our Consulting and Systems Integration team can assist in actually tying all of the current systems together to create better reporting, analysis as required etc. This is also integrated into existing systems and platforms rather than reinventing the wheel.